1. Introduction to EZSUR and its role in insurance data management

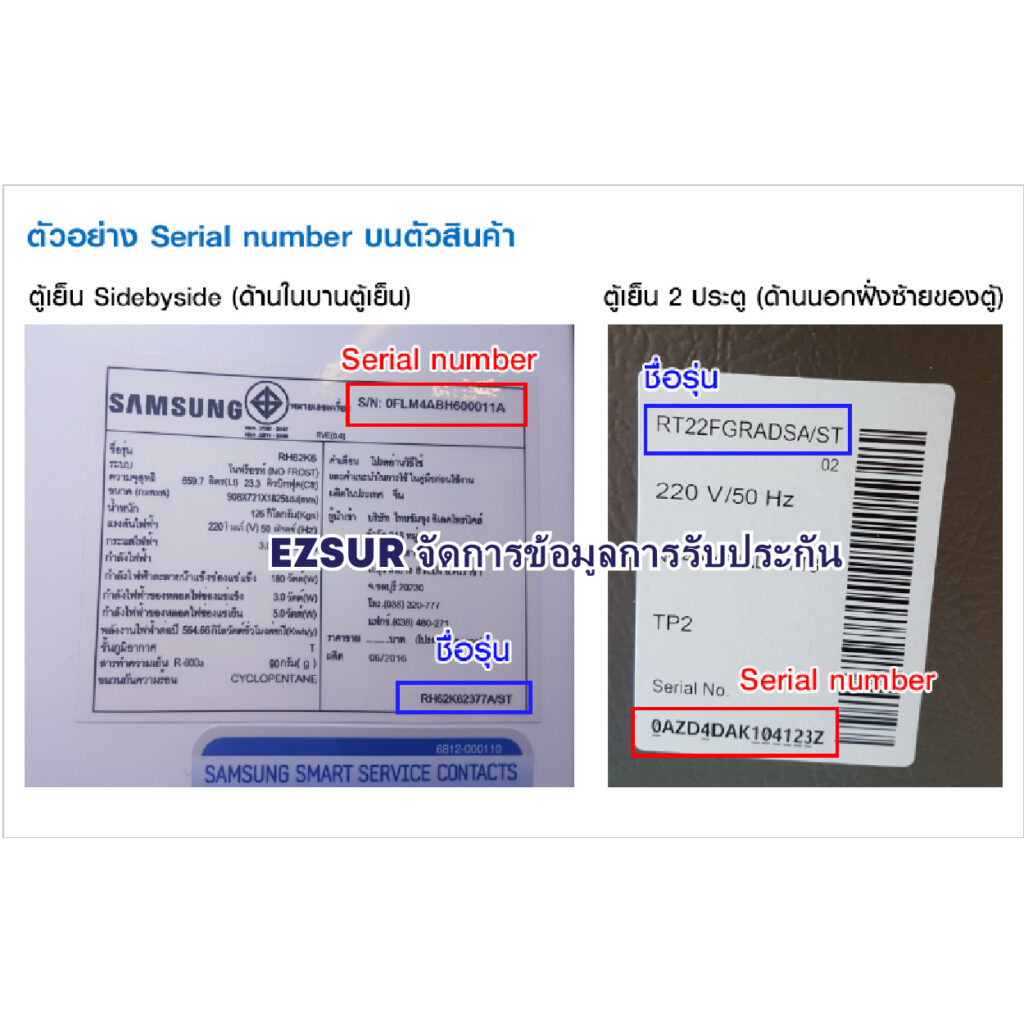

In the intricate realm of insurance operations, the effective management of data stands as a cornerstone of success. EZSUR, a versatile software solution, emerges as a beacon of efficiency, promising to revolutionize the way insurance data is handled. With its intuitive interface and powerful functionalities, EZSUR streamlines the entire process, from data entry to reporting, ensuring seamless operations for insurance companies of all sizes.

EZSUR doesn’t just offer a platform; it provides a comprehensive ecosystem for managing insurance data with precision and agility. By centralizing all information within a unified interface, EZSUR eliminates the need for disparate systems and manual data entry, reducing errors and improving overall efficiency. Whether it’s policy details, claims processing, or compliance management, EZSUR empowers insurance professionals to navigate the complexities of their industry with confidence and ease.

2. Setting up EZSUR for insurance data management

The journey with EZSUR begins with an effortless setup process, designed to minimize disruptions and maximize productivity. From installation to configuration, EZSUR offers step-by-step guidance, ensuring a smooth transition for insurance companies looking to harness its capabilities. Administrators can easily customize user permissions, tailoring access levels to match the specific roles and responsibilities within their organization.

Integration is key to optimizing efficiency, and EZSUR seamlessly integrates with existing insurance systems, minimizing disruption to ongoing operations. Through API connectivity and data import/export features, EZSUR ensures a seamless flow of information across platforms, eliminating silos and streamlining processes. With EZSUR in place, insurance companies can unlock new levels of efficiency and collaboration, laying the foundation for future growth and success.

3. Data entry and collection in EZSUR

Data entry is the foundation of effective insurance data management, and EZSUR simplifies this process with intuitive tools and workflows. Whether it’s capturing policy details, customer information, or claims data, EZSUR provides user-friendly interfaces that streamline data entry tasks. With customizable forms and templates, insurance professionals can ensure consistency and accuracy across all data entry points, reducing errors and enhancing data quality.

Beyond data entry, EZSUR facilitates seamless data collection from multiple sources, including online forms, mobile applications, and integrated systems. Through automated data capture mechanisms, EZSUR minimizes manual intervention, saving time and reducing administrative overhead. Real-time validation checks further ensure data accuracy, empowering insurance companies to make informed decisions based on reliable information.

4. Organizing insurance data with EZSUR

Central to effective data management is the organization of insurance data in a structured and accessible manner. EZSUR offers robust tools for organizing and categorizing data, allowing insurance companies to create custom hierarchies and classifications that suit their unique needs. Whether it’s organizing policies by type, segmenting customers by demographics, or categorizing claims by severity, EZSUR provides flexible options for structuring insurance data.

Tagging and labeling functionalities further enhance data organization in EZSUR, allowing users to add metadata and keywords to facilitate easy retrieval and analysis. By implementing a systematic approach to data organization, EZSUR enables insurance professionals to quickly locate relevant information, track changes over time, and gain valuable insights into their operations.

5. Data storage and security in EZSUR

As custodians of sensitive information, insurance companies must prioritize data security and privacy. EZSUR employs robust data storage mechanisms, leveraging secure databases and encryption technologies to safeguard confidential insurance data. Role-based access controls further restrict access to authorized personnel, ensuring that sensitive information is only accessible to those with proper permissions.

Backup and disaster recovery features provide additional layers of protection, allowing insurance companies to recover data in the event of unexpected incidents or emergencies. With EZSUR’s built-in security measures, insurance professionals can have confidence in the integrity and confidentiality of their data, meeting regulatory requirements and building trust with their customers.

6. Managing insurance policies with EZSUR

Insurance policies are the cornerstone of the insurance industry, and EZSUR offers comprehensive tools for managing policies throughout their lifecycle. From policy issuance to renewal, EZSUR provides end-to-end support for policy management, allowing insurance professionals to track coverage details, premiums, and endorsements with ease. Automated renewal reminders and notifications ensure that policies are renewed on time, minimizing lapses in coverage and enhancing customer satisfaction.

Document generation capabilities in EZSUR streamline the creation of policy documents, certificates, and endorsements, reducing manual effort and improving accuracy. With centralized policy management features, insurance companies can maintain a complete and up-to-date repository of policies, enabling quick access to information and efficient servicing of customer needs.

7. Claims processing using EZSUR

Claims processing is a critical function in the insurance industry, and EZSUR simplifies this complex process with intuitive workflows and automation capabilities. From initial claim intake to final settlement, EZSUR provides end-to-end support for claims processing, allowing insurance professionals to track claims status, assess coverage, and communicate with claimants seamlessly.

Workflow automation features in EZSUR streamline routine tasks, such as claim routing, document verification, and payment processing, reducing manual effort and accelerating claim resolution times. Integration with adjuster tools and external databases further enhances efficiency, enabling insurance companies to access relevant information and make informed decisions quickly.

8. Reporting and analytics capabilities of EZSUR

Data-driven insights are essential for informed decision-making in the insurance industry, and EZSUR offers robust reporting and analytics capabilities to support this need. With customizable reporting tools and dashboards, insurance professionals can generate tailored reports on key performance indicators, such as policy growth, claims frequency, and loss ratios.

Advanced analytics features in EZSUR enable insurance companies to analyze trends and patterns in their data, identifying areas for improvement and opportunities for growth. Whether it’s identifying emerging risks, optimizing pricing strategies, or enhancing underwriting criteria, EZSUR empowers insurance professionals to leverage data-driven insights for strategic decision-making.

9. Compliance and regulatory features in EZSUR

Compliance with regulatory requirements is a top priority for insurance companies, and EZSUR provides robust features to support compliance efforts. From built-in compliance checks to audit trails and reporting tools, EZSUR offers comprehensive capabilities for ensuring adherence to regulatory standards and industry best practices.

Real-time compliance validation checks in EZSUR help insurance professionals identify potential compliance issues early in the process, minimizing risks and penalties. Audit trails provide a complete record of all data changes and user activities, enabling insurance companies to maintain transparency and accountability in their operations.

10. Collaboration and communication within EZSUR

Effective communication and collaboration are essential for success in the insurance industry, and EZSUR facilitates seamless collaboration between insurance professionals, underwriters, and customers. Through built-in communication tools, such as messaging systems and document sharing features, EZSUR enables real-time collaboration and information sharing across teams.

Document management functionalities in EZSUR streamline the sharing and approval of documents, such as policy contracts, endorsements, and claims forms, reducing delays and improving responsiveness. With EZSUR’s centralized communication hub, insurance companies can foster collaboration, streamline workflows, and enhance customer service levels.

11. EZSUR mobile application for insurance professionals

In today’s fast-paced world, mobility is key to staying competitive, and EZSUR offers a mobile application designed specifically for insurance professionals on the go. With the EZSUR mobile app, insurance agents, adjusters, and underwriters can access insurance data anytime, anywhere, from their mobile devices.